Multi-factor Authentication (MFA) in Call Centers: A Complete Guide

by Erina Suzuki | Published On October 22, 2024

Multi-factor authentication (MFA) might not be an entirely new concept for call center leaders, but the value of this technology has grown drastically in recent years. The call center is home to huge volumes of sensitive data, from credit card details to customer names.

Criminals are constantly finding new ways to get their hands on this valuable information, whether it’s by stealing passwords or attempting to impersonate customers with AI. While multi-factor authentication won’t necessarily make a company breach-proof, it does make it harder for the wrong people to gain access to your data.

In fact, MFA can prevent up to 99.9% of account compromise attacks. As customers, government groups, and regulators alike place more pressure on call centers to defend data effectively, every company should be exploring the benefits of multi-factor authentication.

This guide will introduce you to what MFA is, how it works, and the best practices you can use to implement it efficiently into your call center.

What is Multi-factor Authentication (MFA)?

Multi-factor authentication (MFA) is an authentication method that requires individuals to provide multiple forms of verification to prove their identity. It provides an advanced alternative to single-factor authentication methods (such as asking customers to provide a PIN or password). Plus, it can be more effective way to authenticate individuals than one-factor authentication.

Where one-factor authentication only involves two steps in the identification process, such as entering a password, MFA often involves three or more forms of identification. That’s why multi-factor authentication is often considered more secure.

Even if a criminal gains access to a customer’s password, they’re less likely to have all the details they need to bypass a multi-step authentication mechanism.

The Types of Identification in Call Center MFA

As cybersecurity threats and fraud issues in the call center continue to evolve, the number of “identification” methods that can be used for MFA is increasing. These days, some companies are even experimenting with artificial intelligence, to bring biometric data into the mix.

Typically, though, multi-factor authentication in the call center will ask for specific data aligned to three specific areas. These include:

1. Something you know

Knowledge-based identification relies on customers sharing something only they should know with the system. This could be a PIN, password, an answer to a security question, or something more dynamic, like what their most recent purchase was.

2. Something you have

Possession-based identification requires customers to use something they have in the next stage of the identification process. In a physical setting, this might be a key fob or a smart card. In a call center conversation, it might involve sending a one-time passcode to a physical device via SMS, email, or a push notification.

3. Something you are

Inheritance-based factors are now increasingly common in multi-factor authentication. These involve using AI to identify specific biometric factors in a caller. For instance, call centers might use intelligent IVR systems with natural language processing capabilities to identify a customer based on their voiceprint.

The Importance of Multi-Factor Authentication in Call Centers

Ultimately, MFA in the call center is important because it ensures companies can more effectively protect their data and fight back against the growing issue of fraud. In the last couple of years, more than half of the respondents in one study agreed that fraud attacks in the call center are increasing.

The security issues facing call centers are only growing more complex. Not only do criminals now have more sophisticated ways to access standard authentication credentials like passwords and PIN codes using phishing and social engineering techniques, but they’re also leveraging AI.

Advanced AI tools are becoming increasingly effective at creating “deepfakes” that can bypass some of the most advanced security systems. MFA essentially adds an extra layer of defense to the authentication process, making fraud and data theft more challenging.

With the right approach to MFA, companies can:

- Increase security: MFA strengthens security in the call center by requiring users to provide access to multiple forms of information. It can address the limitations of password-only authentication, and even two-factor authentication, reducing the risk of compromises.

- Boost compliance: Implementing multi-factor authentication can help organizations adhere to evolving data security and compliance standards. Certain regulations, like PCI-DSS, even require MFA to be implemented in certain circumstances to reduce the risk of fraud.

- Improve customer experiences: Multi-factor authentication, when implemented correctly, can improve customer experience and satisfaction. Customers who know their data is being well protected are more likely to trust your company and remain loyal to your brand.

- Cost savings: MFA can even help reduce costs, by protecting companies from the expenses associated with receiving regulatory fines, responding to data breaches, and recovering from reputational damage.

How MFA Works in Call Centers

Increasingly, call center solution providers are offering access to MFA solutions as a standard for growing businesses. These platforms include all the tools companies need to automate the process of authenticating customers using multiple different types of data.

Usually, when customers call a company, or set up an account with a business online, they’ll be guided through an onboarding process that informs them of how the MFA process will work. They’ll usually need to set up a password and username for an account, then complete certain tasks before future conversations and transactions commence.

Since “static” data about what a customer knows can be stolen just as easily as passwords, it is recommended to use something that cannot easily be stolen such as:

- Biometric authentication: Biometric authentication can include everything from fingerprint scans to facial scans. In the call center, the most common form of biometric authentication is voice printing, which involves using AI to identify a user based on numerous factors in their voice, such as their tone, accent, and cadence.

Or use dynamic solutions, such as:

- Adaptive questions: These are questions asked to authenticate a user based on recent data the company has collected. For instance, a bank might ask what the last company you purchased a product from was called, or when you last received a payment into your account.

- One-time passcodes: OTP (one-time passcodes) are randomly generated codes sent to a customer’s phone via SMS or push notification, or their email address. These codes only last for a short period of time, so they can’t be stolen or reused at a later stage.

Some companies even integrate their contact center solutions with third-party apps for authentication, like the Google or Microsoft Authenticator apps.

Best Practices for Implementing MFA in Call Centers

Implementing MFA effectively into the call center can be complicated. You need to not only choose the right MFA strategy to adapt to your compliance and security needs but also ensure you’re implementing measures to ensure a consistent and positive user experience.

Here are a few best practices to keep in mind.

1. Choose your MFA Solution Carefully

Multi-factor authentication technology for the call center isn’t a one-size-fits-all solution. There are many different types of MFA systems out there, from solutions that use authentication apps, to automated systems for sending out one-time passcodes, and biometric solutions powered by AI.

The right solution for you will depend on your security needs, budget, and the preferences of your customers. It’s also worth making sure that the MFA solution you implement can integrate effectively with the tools your call center team already uses. This includes not just your contact center as a service (CCaaS) software, but also databases, like your customer relationship management (CRM) tools.

Access to a CRM and other databases can allow AI and automated systems to more rapidly authenticate users based on the information you collect over time.

2. Offer User and Employee Training

Multi-factor authentication solutions can only work effectively if people are consistently using them. You need to ensure your employees are aware of how to set up MFA for new account holders, and how to leverage multi-factor authentication techniques when accessing sensitive data and software.

At the same time, it can be important to explain the purpose and value of MFA strategies to your customers. Answering multiple questions or performing various authentication tasks can be frustrating for time-pressed customers (as well as employees).

Making sure all your users know the benefits of implementing MFA and how it will help keep them and their data safe will increase adoption rates and improve the ROI of your solution.

3. Create a User-Friendly Experience

As mentioned above, lack of adoption of MFA is usually caused by frustration. Customers and users don’t always have time to answer questions or speak “activation” phrases to an AI system when they’re trying to gain access to their account.

Plus, if users are working with multiple different companies, there’s a good chance they have numerous passwords and authentication questions to remember. That’s why around 40% of people forget the correct responses to security questions over time.

Where possible, try to make it easy for users to complete authentication process, without compromising on security. Consider offering multiple authentication options, like the ability to choose between using an app or getting a one-time passcode sent to their email.

If you’re using adaptive MFA techniques, such as asking customers about recent account information, prepare multiple questions, just in case they can’t answer the first query.

4. Prioritize Compliance with Industry Standards

Effective authentication is a core aspect of many different data security regulations, from HIPAA and GDPR, to PCI-DSS. Each sector and regulator, however, may have different requirements to keep in mind. For instance, PCI-DSS requires three-factor authentication for servers handling financial data.

Read up on the regulations that affect your company and use the insights you gain to determine what type of MFA strategy you should implement. Additionally, make sure you’re staying up to date with changes in data governance and regulatory standards.

Regularly review your authentication strategy when new security guidelines emerge and conduct regular penetration tests and reviews to ensure your efforts are paying off. Remember, the threat landscape is always changing, so you’ll need to constantly upgrade your authentication strategies as new risks appear in the call center.

5. Combine MFA with Other Security Strategies

On its own, multi-factor authentication in the call center can significantly improve your security standing. However, you can also take things to the next level, by combining it with other security measures. For instance, combining MFA with other solutions like SSO (Single-Sign-On) can be extremely helpful.

SSO eliminates the needs for users to remember various passwords by allowing them to log into various apps and tools with a single set of credentials. Using MFA and SSO in combination with your call center teams can help reduce the risk of internal breaches, as employees will be less likely to use simple, repetitive passwords to access tools.

Additionally, MFA strategies work perfectly with Zero Trust Network Access (ZTNA) strategies too. ZTNA methods ensure that only certain people have access to essential data and applications. By implementing this measure into your call center, you ensure that fewer members of staff have access to extremely crucial data, reducing the risk of significant data breaches.

6. Experiment with Innovative Technology

Finally, it’s worth exploring new ways to make multi-factor authentication more intuitive for your users. Password-less authentication strategies that leverage AI and biometrics are becoming increasingly popular in the call center. These solutions reduce the common reliance on traditional passwords by allowing a system to authenticate customers based on specific characteristics such as their facial features, their fingerprints, or their “voiceprint”.

Biometric solutions built into an IVR system can streamline the authentication process for users, leveraging natural language processing and understanding mechanisms. However, it’s important to remember there are risks to using these solutions too. For instance, generative AI can now be used to create “deepfakes” of customer voices.

This makes it extremely important to ensure your AI solutions have the right training and algorithms available to distinguish between live voices and recordings.

Secure your Call Center with Multi-Factor Authentication

Multi-factor authentication is quickly becoming essential to the call center. It’s not just a crucial way to upgrade your data security strategies and adhere to evolving regulations. Implementing the right MFA strategy can help you earn trust and improve the customer experience.

ComputerTalk makes it easy to implement intuitive MFA practices into every part of your organization. You can use MFA to improve the security of employee accounts when they’re accessing sensitive data and call center software. You can also use various types of MFA to authenticate customers when they contact your team and protect their identity. Our AI-powered tools even make password-less authentication an option, with biometric voice recognition.

Contact ComputerTalk today to learn more about our cutting-edge authentication and security solutions or check out our in-depth guide.

More from our blog

As someone who has been going to in-person Microsoft conferences for 15 years, the last couple of years have been a real change in routine. There was always a regular cadence of two or three events a year, typically Build...

As someone who has been going to in-person Microsoft conferences for 15 years, the last couple of years have been a real change in routine. There was always a regular cadence of two or three events a year, typically Build...

Automated messaging has revolutionized customer engagement in countless industries. In the education industry, automated messaging allows organizations to connect efficiently with students, parents, and other community members.

Automated messaging has revolutionized customer engagement in countless industries. In the education industry, automated messaging allows organizations to connect efficiently with students, parents, and other community members.

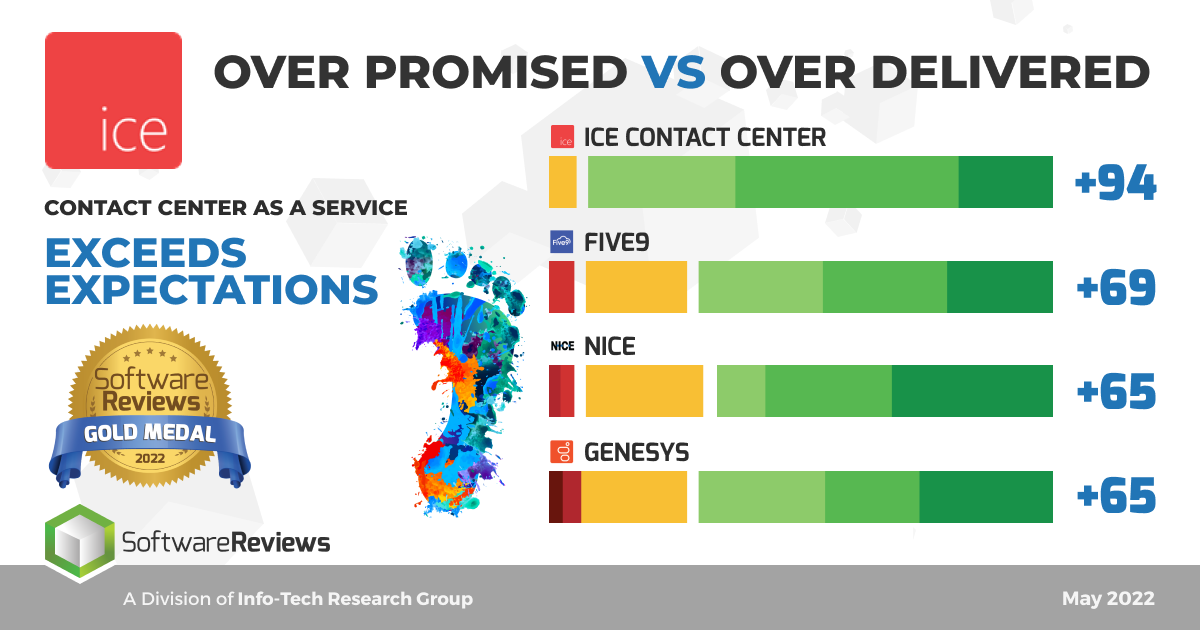

ComputerTalk is excited to announce that we’re scored a leader in exceeding client expectations in InfoTech Research Group’s SoftwareReviews.

ComputerTalk is excited to announce that we’re scored a leader in exceeding client expectations in InfoTech Research Group’s SoftwareReviews.